From Pixels to Ports: Keeping Supply Chains Moving

End-to-end sightlines are no longer optional

From mining operators dispatching rare-earth concentrates out of Madagascar to logistics managers tracking container dwell times in Singapore and carrier risk officers monitoring piracy in the Gulf of Aden, one reality now dominates: you need eyes on every link, every day.

Legacy tools like weekly satellite snapshots, port-call data, and customs reports have a role, but they’re siloed and often outdated by the time they reach the operations room. Meanwhile, customers, regulators, and investors demand proof of ESG compliance, on-time delivery, and tariff-driven route agility. Waiting days to learn a vessel diverted, a terminal jammed, or a plant halted for lack of cobalt is no longer acceptable when hours can cost millions in demurrage, stockouts, or penalties.

At Bedrock, we've built a real-time monitoring solution that does the heavy lifting, keeping analysts focused on mission-relevant activity and decision makers ahead of the curve.

The multi-modal edge

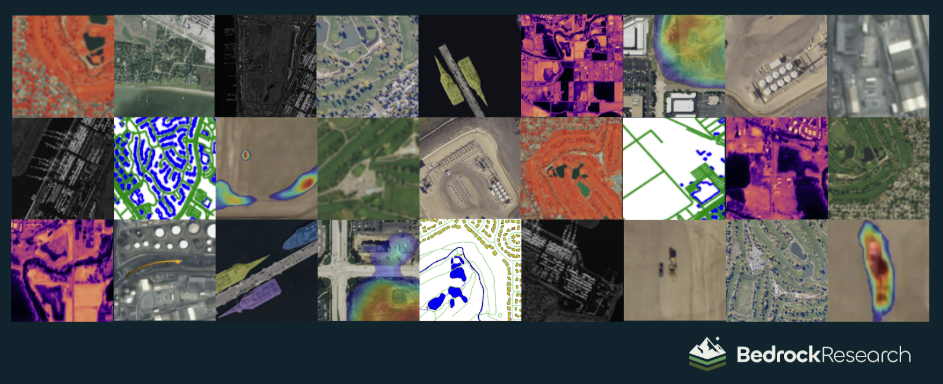

Bedrock fuses diverse sensor streams like optical, radar, AIS, RF, thermal, hyperspectral, and open-source, to deliver a unified view of supply chain activity.

Unlike most pixel-level monitoring products, we focus on fusing multiple data together in order to create a seamless force multiplier that provides intelligence into how and how significantly change has occurred. In other words, our solution focuses teams on areas of mission-relevant change, and offers rich, predictive insights in ways that single-data offerings cannot.

Other monitoring services are often limited to one or two types of data inputs, which can cause interruptions from clouds and darkness, or expose spectral blind spots.

“You no longer need five dashboards and a data science team to stitch the story together; we do it for you.”

We remove blind spots by ingesting them all, plus social-media whispers, drone orthomosaics, and your own IoT sensor data, into one data fusion engine. Cross-validation removes false positives and serves a single, trustworthy place for global ops, finance, and risk teams.

From reactionary to anticipatory

In global supply chains, velocity and precision spell the difference between seamless throughput and multi-million-dollar demurrage bills. Our monitoring solution hinges on a data fusion engine with two AI pistons, anomaly detection and semantic annotation, that surface critical events faster than any port audit or AIS refresh and explain exactly why they matter to schedule, security, and regulatory compliance.

Anomaly detection: Real-time data inputs are compared against both a last-known-good baseline and a long-term-average baseline to distinguish expected changes from abnormal, attention-worthy ones. With this understanding, it flags mission-relevant anomalies like extra-long vessel queues, sudden container piles, flooded rail spurs, or strike-induced yard idle time, often within hours, not the next data cycle.

Semantic annotation: Using small-sample learning, we train computer-vision models on the anomalies you must never miss, and must understand: suspicious trans-shipment in sanctioned waters, shadow tankers with AIS dark, unexpected heat signatures at customs-bonded warehouses, or fast-growing sandbars threatening draft-limited channels.

Together, anomaly detection pinpoints what and where change occurred, while semantic annotation explains how it changed and why it jeopardizes throughput, cost, or compliance KPIs.

In this example, cross-modal analysis of optical and SAR imagery demonstrates seamless, persistent monitoring of the Port of Hong Kong, where a ship of interest was discovered to have left and returned seven days later.

Your trusted 24/7 operational partner

Our multi-sensor fusion expedites detection latency from days to mere hours, and flags disruptions before they ripple through the network. Here’s how our monitoring solution keeps global supply chains moving on schedule, within budget, and in full regulatory compliance:

Partnering with Bedrock means entrusting your network to a monitoring solution engineered for fail-safe reliability. Our cloud-native engine delivers 99.9% uptime, multi-region redundancy, and end-to-end encryption that protects sensitive cargo manifests, routing plans, and trade-lane intelligence.

Every alert is validated by multiple sensor streams—optical, SAR, AIS, ADS-B—and a human-in-the-loop QA step, so carriers, freight forwarders, port authorities, and regulators act on signals, not noise.